Ever wondered what actually happens if your drone crashes into a car, a building, or someone’s property?

For many pilots, that question only comes up after something goes wrong. As drones are used more widely across industries like construction, surveying, public safety, media, and inspections, the financial and legal risks increase just as quickly.

This is where drone insurance comes into play.

Even the most skilled drone pilots face unpredictable situations: technical malfunctions, sudden weather changes, or simple human error. In the best-case scenario, these issues might only damage your drone; in the worst case, they could harm others or their property.

Drone insurance isn’t just about protecting your hardware. It also covers legal and financial liabilities unique to drone operations.

As drone tech evolves, so do the risks and the insurance landscape. In 2025, new FAA enforcement rules and rising concerns about cyber liability are prompting pilots to rethink their coverage strategy.

That’s exactly why we’ve updated this guide.

Whether you’re a commercial pilot flying under Part 107 or a hobbyist capturing landscapes, the right insurance gives you critical protection. It safeguards your gear, your reputation, and most importantly, your wallet.

This guide will help you navigate through the various aspects of UAV insurance in the United States. We will break down the different policies available and show you how to choose the right one.

First, let’s take a look at why drone insurance is important.

Why Do You Need Drone Insurance?

With drones, you can take stunning photos, capture smooth videos, conduct inspections, deliver consumer products, and much more.

However, with great power comes potential danger, and therefore, greater responsibility.

Having drone insurance is one of the best ways to get peace of mind and financial protection from drone risks.

Here’s why drone insurance is an essential investment:

1. Liability Shield

Imagine your drone malfunctioning and falling onto someone, injuring them or damaging property. The resulting medical bills or repair costs could be substantial. This is where drone insurance with third-party liability coverage comes to the rescue. It acts as a safety net, covering these unexpected expenses and saving you from financial hardship. This is especially important if you fly your drone near populated areas or sensitive infrastructure.

2. Crash Protection

Accidents happen, even to the most skilled pilots. A gust of wind, a miscalculation, or a sudden obstacle can send your drone tumbling. Drone insurance has your back in these situations, helping you recover the costs of repairs or even replacing your damaged drone. This can save you a significant amount of money, especially for high-end drones.

3. Client / Employer Requirements

If you’re using drones for commercial purposes, many employers or clients will require you to have drone insurance. It’s a standard prerequisite for working on certain projects or flying in specific areas. Drone insurance demonstrates your professionalism and readiness to handle potential risks, making you a more attractive candidate for job opportunities. This requirement not only helps protect your clients but also boosts your credibility and reliability as a drone operator.

4. Legal Necessity

In many regions, drone insurance is mandatory, particularly for commercial operations. Having a valid policy shows you’re following the rules and helps you avoid fines or penalties. It shows you’re a responsible drone operator who prioritizes safety.

In 2024, the FAA began enforcing Remote ID compliance. If your drone doesn’t meet these requirements, your insurance provider can reject a claim, even if you have an active policy.

So, it’s important that you install a Remote ID module or fly a compliant drone to stay covered.

5. Peace of Mind

Drone insurance is more than just following the law. It’s an investment in peace of mind. Knowing you’re covered allows you to relax and focus on capturing stunning aerial footage or completing your mission. You don’t have to constantly worry about the potential financial burden of an accident. This lets you fly with confidence and enjoy your drone to its fullest potential.

But which drone insurance should you choose? Let’s break it down.

Types of Drone Insurance Coverage

Similar to other insurance types, drone insurance also provides a wide range of coverage areas.

Let’s take a look at some of them:

1. Hull Insurance

Hull insurance covers damage to the actual drone. Physical damage that affects your drone itself. If your drone crashes, malfunctions, or has an accident, this insurance can help with the repair or replacement costs. With some Insurance providers, such as SkyWatch.ai, it will also cover theft, flyaway, and disappearance. Keep in mind this does not cover the payloads – sensors, etc. These ancillary items must be listed separately on your policy to be covered (See “Payload Insurance” below).

2. Liability Insurance

If your drone causes harm to other people or damages their property, this insurance will protect you from financial responsibility. This is especially important for commercial drone operators who fly in populated areas where the risk of injury or property damage is higher.

Pro Tip: Always verify that your policy covers third-party property damage and privacy claims, the two areas that many basic liability plans exclude.

3. Payload Insurance

If you have special equipment like cameras, sensors, LiDAR, or mapping tools attached to your drone, this insurance covers damage, loss, or theft of that payload.

Note that payload coverage isn’t automatically included; you must specifically list each payload item in your policy.

4. Ground Equipment Insurance

This insurance covers the equipment you use on the ground to control your drone, like extra remote controls, base stations, cameras, and any other equipment you add to your policy. Some companies, such as SkyWatch.ai, will include these items with Payload insurance under ”Equipment Insurance”.

5. Personal Injury Insurance

Personal and Advertising Injury Coverage protects drone operators against claims related to libel, slander, defamation, wrongful eviction, or false advertising.

This coverage is especially important for pilots involved in aerial photography, videography, or surveillance, where footage might inadvertently capture private property or individuals.

Providers like SkyWatch.AI also include protection against privacy violations, helping you avoid costly legal exposure tied to how your drone content is used or shared.

6. Cyber Liability Insurance

Drone missions now involve cloud-based data processing, especially for mapping and inspection. When you store or transmit this data, you expose yourself to cyber risk.

Cyber liability coverage protects you if a client’s data is breached, hacked, or accessed without authorization during drone operations. Some policies now include this coverage as an optional add-on.

7. Non-Owned Coverage

Drone pilots may find themselves in a position in which they are flying another drone pilot’s drone, i.e., a drone they do not own. While most carriers that we’re aware of do not offer insurance dedicated to non-owned drones, you can usually still cover them as you do with one of the drones you own.

Pro Tip: If you fly multiple drones for commercial work, ask your insurer about fleet coverage. It often costs less than insuring each aircraft individually.

Before choosing a drone insurance policy, consider what kind of coverage you need based on how you use your drone. For example, if you own a business, you must look for drone business insurance that provides extensive coverage.

If you’re just starting or planning to turn your flying skills into a business, check out our detailed guide on How to Start a Drone Business. It walks you through registration, compliance, client management, and choosing the right insurance for commercial operations.

As always, policies and coverage can vary from provider to provider, so it’s recommended to compare multiple options. You can also talk to an insurance agent or attorney who knows about UAV insurance to help you with the process. For a deeper look at FAA rules and compliance tips, check out our guide on New Drone Laws in the USA.

Cost is another important factor to consider when choosing drone insurance.

How Much Does Drone Insurance Cost in 2025?

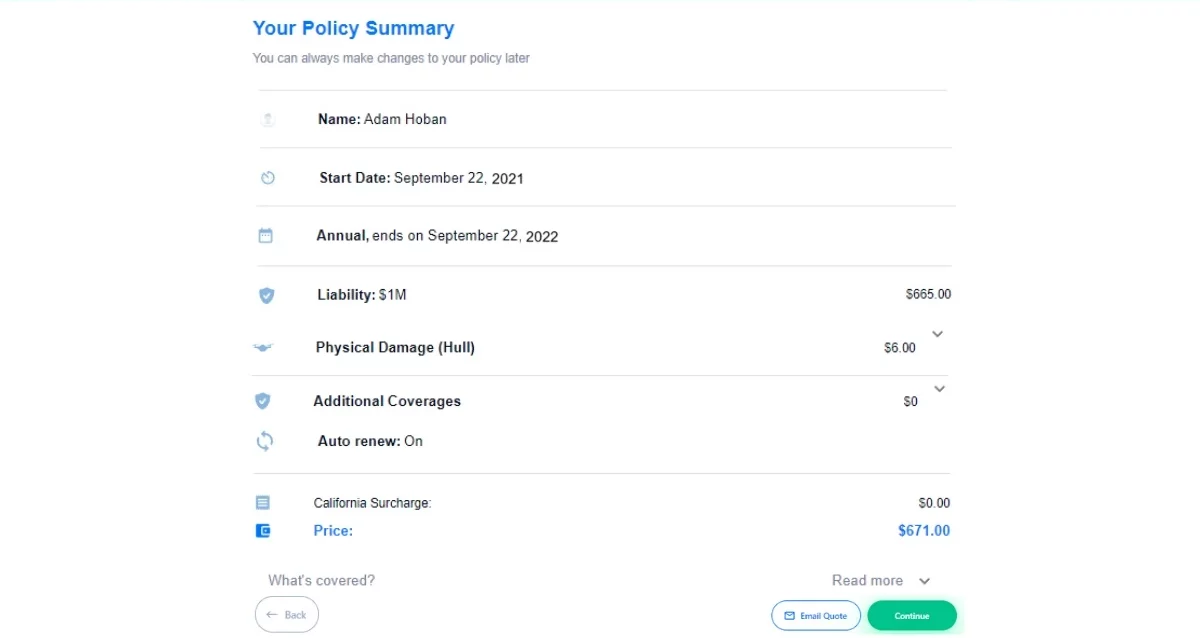

| Coverage Type | Typical Cost Range | Details |

| Liability Insurance | $500 – $1,000/year for $1M coverage | Can go higher for riskier jobs. For example, $5M+ CSL for film or construction |

| Hull Insurance | 8% – 12% of drone value per year | Covers physical damage to the drone; may require an itemized list |

| Payload Insurance | Varies based on equipment value | Covers gimbals, cameras, sensors; not always included by default |

| Ground Equipment | Add-on, often bundled with Payload | Includes remotes, tablets, and field gear; varies by provider |

| Cyber Liability | Add-on, quoted separately | Required for mapping or inspection jobs with data risks |

| Hourly Insurance | $5 – $15/hour | Offered by SkyWatch, AirModo. Also, rates vary by location and risk |

| Monthly Insurance | From $62/month for $1M liability | Best for pilots with light to moderate flight frequency |

| Annual Plans | ~$650/year (liability only) | Bundles liability and hull for regular commercial operators |

The cost of drone insurance varies significantly depending on several factors, including:

- Type of coverage

- Amount of liability coverage selected

- Value of the drone and related ancillary equipment included in the policy

- The purpose for which the drone is being used (for example, basic marketing videos vs inspections of complex infrastructure assets)

- Pilot experience

- Geographical location where the drone will be flown.

1. Liability Insurance

Drone liability insurance is usually the most expensive insurance. It can start from $500 to $1,000 per year for $500,000 to $1 million coverage, but it may go up if your drone operations are considered riskier.

Clients such as large production houses and big construction companies may even ask drone pilots to purchase coverage with a $5 million CSL (Combined Single Limit) or even more.

Combined Single Limit is the total of bodily injury liability coverage and property damage liability coverage.

2. Hull Insurance

It is often around 8-12% of your drone’s value per year. For example, if your drone is worth $1,500, hull insurance might cost around $120 to $180 per year.

Invasion of Privacy, Personal Injury, and Cyber Liability Insurance can be added to a drone liability policy, but the cost depends on the insurance company and the specifics of your drone use.

3. Monthly and On-Demand Insurance

Some companies offer short-term insurance options. For example, with SkyWatch.ai, you can cover your drone by the hour, with rates ranging from $5 to $15. These rates can increase depending on the details of the flight and the drone risk involved in the area. Another good choice for those who don’t fly a lot is to go with a monthly coverage starting at $62 for $1M coverage.

Insurance companies are prone to considering the depreciated value and not the actual market value when settling a claim. So, avoid inflating your drone’s value when buying insurance.

Typically, liability-only drone insurance costs for coverage of $1 million is around $650 per year. If the cost of your Hull insurance amounts to 10% of the cost of the drone, you’d be looking at a total insurance invoice of $750 for the year.

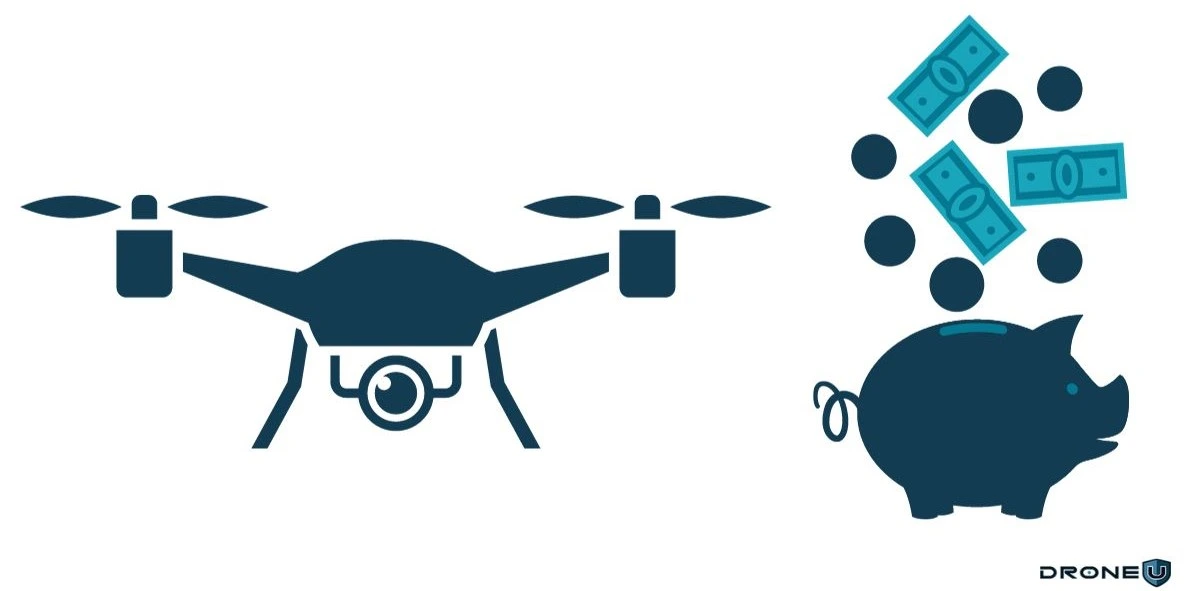

Your UAV insurance cost will further increase if you opt for any add-ons like ground equipment coverage and payload coverage. We strongly recommend purchasing a higher drone liability insurance limit if you are taking on risky drone jobs.

How Can You Save on Your Drone Insurance Cost?

First, insurance is negotiable. So do not be afraid to haggle. After all, a penny saved is a penny earned. Secondly, your experience and training will be taken into account. Remember, your insurance policy is often reviewed by an underwriter.

Many of the providers drone pilots choose to purchase from have fairly fixed pricing for the standard types of usage, which most drone pilots fall into. So, there may be fewer opportunities for haggling in these cases. But it never hurts to ask.

If you have a long, accident-free flying history and have undergone drone training from an organization of repute, these factors will work in your favor. Your drone crash insurance cost also depends on the nature of the job and the associated risk.

So, if you are using your drone for agricultural mapping, your insurance cost is likely to be lower compared to someone who is flying in areas of heavy interference.

Next, if you are an established player with a fleet of drones, you are likely to be offered a better deal. Your per-unit drone crash insurance cost is likely to be lower.

You can also save on insurance costs by uploading your flight logs to insurers like SkyWatch. This helps prove safe flying and earn a Safety Score. Based on your score and track record, they offer premium discounts of up to 30%.

Also, for extremely small damages, it is not worthwhile to file a claim. Typically, deductibles are pegged at 5% of the insured value. So, for small damages, it would be financially prudent to bear the cost yourself. Moreover, the lower number of claims filed will result in lower insurance costs in the future.

Finally, do not hide any information from your broker in a bid to get lower coverage. This is a strict no-no.

Validity Periods of Drone Insurance Policy

It’s important to know how long your policy will be valid before you buy it. Generally, UAV insurance policies are offered for specific durations.

|

Short-Term Policies |

Annual Policies |

| These policies might cover your drone for a single flight or a limited period, such as a day, a week, or a month. These policies are often used by individuals or businesses that need coverage for a specific event, project, or short-term activity. | Many insurance companies offer annual policies that provide coverage for an entire year. These policies are suitable for drone operators who fly their drones regularly and want continuous coverage without the need to purchase insurance for each flight. It will also offer the best value for money compared to short-term policies. |

Best Drone Insurance Providers

In the vast market of drone insurance providers, each company has its unique strengths and specialties. Here is a quick comparison of the top drone insurance companies so you can make an informed decision.

| Provider | Liability | Hull | Payload | Ground Equipment | On-Demand Options | Best for |

|---|---|---|---|---|---|---|

| SkyWatch.AI | Yes | Yes | Yes | Yes | Hourly/Monthly/Annual | Customizable plans, usage-based discounts |

| AirModo | Yes | No | No | No | Hourly/Annual | Fast, app-based liability coverage |

| Bullock Agency | Yes | Yes | Optional | Optional | Not advertised | Personalized policy consultation |

| Avion Insurance | Yes | Yes | Optional | Optional | Not available | Recreational pilots looking for low-cost coverage |

| State Farm | Yes (for Recreational use only) | Yes | No | No | No | Recreational pilots looking for low-cost coverage |

| Global Aerospace | Yes | Yes | Yes | Yes | Not advertised | Enterprise and global operations |

| DJI Care Refresh | No | Yes | DJI Payloads | No | No | DJI owners seeking replacement coverage |

| BWI | Yes | Yes | Yes | Yes | Not advertised | High-limit liability, complex commercial jobs, and pilots needing direct agent support |

| Avalon Risk | Yes | Yes | Yes | Yes | Not advertised | Enterprise, high-value, RPAS operators |

| AIG | Yes | Yes | Yes | Ground crew covered | Not advertised | Public sector, BVLOS, anti-spoofing coverage |

How to Use This Comparison Table

Drone insurance providers serve very different types of pilots and operations. Before choosing one, it helps to understand who each provider is best suited for. Use the categories below to narrow your options quickly.

Best for On-Demand Coverage

Ideal for freelancers, part-time pilots, and operators who don’t fly every week.

- SkyWatch.AI

- AirModo

Best for Enterprise Operations

Designed for large fleets, higher liability limits, and complex missions.

- Global Aerospace

- AIG

- Avalon Risk

Best for Recreational Pilots

Simple protection for hobby flying, not commercial work.

- State Farm

- DJI Care Refresh

Best for International Flights

Suitable for cross-border operations and global missions.

- BWI

- Bullock Agency

- Avion Insurance

1. SkyWatch

Best for: On-Demand Coverage

SkyWatch.AI is one of the most popular drone insurance providers for both recreational and commercial pilots. It offers comprehensive insurance policies that you can customize based on what you need with a few clicks online. You can choose how much coverage you want for liability, hull damage to your drone, third-party property damage, and even coverage for the risk of invasion of privacy. Once you purchase a policy, the Certificate of Insurance (COI) will be emailed to you, so you’re ready for your next mission in minutes.

With SkyWatch, you can buy coverage by the hour, month, or year directly through their mobile app. The company holds a 4.9-star score on reviews and is considered to have some of the best customer support in the market.

Coverage Highlights:

- Liability: up to $10 million

- Hull and equipment: full replacement value

- Optional coverage for non-owned drones and payloads

- Available in all U.S. states

Enroll in our ‘Don’t Crash Course’ to become a safer pilot and save money on an insurance policy.

2. AirModo

Best for: On-Demand Coverage

AirModo offers drone operators fast, simple, and affordable drone insurance in a single, easy-to-use app. They state: “We are committed to providing you with a best-in-class insurance solution that costs less than the other drone insurance providers.”

They offer policies from hourly to annual, depending on your specific needs, including whether you’re flying for recreational or commercial purposes.

AirModo is available in all 50 states, as well as D.C. and Puerto Rico.

Airmodo offers only liability coverage for incidents that occur while using the unmanned aircraft system noted on your policy. It does not pay out for hull, physical damage, or replacement of your drone or payload.

3. Bullock Agency, Inc.

Best for: International Flights

Bullock Agency has been a trusted insurance company for more than 30 years. They are experts in aviation insurance and offer different types of drone insurance policies to both businesses and individuals.

One of the great things about getting drone insurance from Bullock Agency is that they have a team of experienced professionals who are experienced in the field of aviation insurance, including drone coverage. They can guide you to identify the drone insurance policy elements that fit your specific needs.

4. Avion Insurance

Best for: International Flights

Avion Insurance is a well-known company with a long history of insuring aircraft. They understand the potential risks that come with drones. Avion’s UAV insurance policies offer coverage for both liability and physical damage. Their policies are also customizable, so you can choose the coverage that best meets your needs.

5. State Farm Drone Insurance

Best for: Recreational Pilots

State Farm Drone Insurance Policy is like a solid protection plan for your drone if you are a recreational pilot. It covers your drone if it gets stolen, accidentally damaged, or faces certain dangers. It is one of the best recreational drone insurance options.

If your drone suffers physical damage or goes missing because of an accident or theft, you can ask State Farm for help. The good thing is that it’s reasonably priced, and in most cases, you won’t have to pay any deductibles. Isn’t that cool?

Check out our comprehensive State Farm Insurance Review to learn more.

6. Global Aerospace

Best for: Enterprise Operations

Global Aerospace Drone Insurance is the Underwriting entity for many, if not most, of the policies that are written for UAS pilots in the US. They also provide policies directly if you prefer that option. Their comprehensive plans include all the usual coverages. These cover damage to the drone, liability for any harm or property damage caused to others, and risks such as invasion of privacy.

They also provide coverage for non-owned drones. The insurance is quite inclusive, safeguarding against third-party liability, damage to the drone, its contents, and related equipment, as well as privacy invasion and medical expenses.

Their policies are available for both recreational and commercial drone users. One other great feature of a policy direct from Global is that you are covered anywhere around the world.

7. DJI Drone Insurance

Best for: Recreational Pilots

For those of you who are flying DJI drones, the coverage offered by DJI can be a good option. Depending on the age and type of DJI drone you’re flying, your options will include:

DJI Care – This is the coverage that was offered for what are now older drones, like the older Phantoms and Inspires. It covers damage to your DJI aircraft, gimbal, or camera during either normal use or accidental damage.

DJI Care Refresh – This is a 12-month service plan that provides complete and comprehensive coverage in the event your DJI product is damaged during normal use. This product offers the pilot up to two product replacements in one year or four in two years (requires an additional fee for the second year). Covered situations include Collisions, Water Damage, and even Normal wear and tear.

DJI discontinued Care Refresh Plus in July 2023. However, this change came with some helpful upgrades to the standard Care Refresh plan. Pilots can now extend coverage to a third year and purchase specific protection for flyaways.

As with any insurance coverage, it’s important to review the fine print to ensure the product meets your needs.

8. BWI | FLY

Best for: International Flights

BWI has been providing aviation insurance since 1977 and has been a proactive and innovative contributor to the aviation industry since it began. This culture transitioned smoothly into drone insurance as the UAS industry began to grow and the needs of drone pilots became more profound.

They offer a wide range of products, including liability coverage up to $25,000,000, physical damage (Hull coverage), and payload coverage. They also cover what are considered to be more risky operations, such as drone delivery.

9. Avalon Risk Management

Best for: Enterprise Operations

Avalon Risk Management offers drone insurance policies designed for both individual pilots and enterprise operations. Their coverage includes:

- Third-party liability

- Physical damage (hull) coverage

- Payload or property coverage

- Ground station and launch system protection

- Transit and in-storage coverage

- Optional add-ons for war risk, like hijacking or terrorism

Avalon issues an all-in-one Remotely Piloted Aviation System (RPAS) to manage your entire risk portfolio. It is a good fit for operators who fly internationally, handle expensive drones, sensitive missions, or critical infrastructure clients.

10. AIG – Unmanned Aircraft Systems

Best for: Enterprise Operations

AIG offers a dedicated insurance program for unmanned aircraft systems. In addition to this, their policies cover both physical damage and third-party liability.

Their policy includes:

- Physical damage coverage, including electronics failure.

- Coverage for non-pilot operators and ground crew under the same policy terms.

- Optional extensions for hijacking or spoofing, protecting against unlawful seizure or signal manipulation.

The UAS team uses AIG’s global aerospace underwriting expertise, claims support, and loss-control services. This policy is a great choice for public entities, municipalities, or companies flying in high-risk or tech-sensitive environments.

Still not sure which drone insurance to choose? Let us help.

How to Choose the Right Drone Insurance Plan?

Choosing the right drone insurance depends on multiple factors, including the kind of flying you do, the value of your equipment, and the potential risks you face.

Here’s a step-by-step guide to help you pick the best drone insurance for your needs:

1. Determine Your Needs

The first and most important element to consider when beginning your search is to determine if you’ll be flying for fun or business. Generally, commercial pilots will need beefier coverage. If you’re flying recreationally, your risks are likely to be much lower. In many cases, as a recreational pilot, your homeowner’s policy may be all you need. It’s always best to check with them first.

As a commercial pilot, you’ve likely got business interests to consider, such as assets, employees, the types of work you’re doing, and many other considerations.

How often you fly also matters: if you’re an occasional flier, think short-term insurance. Terms like monthly or even hourly if that fits your paradigm.

If you fly more frequently, a longer-term plan (usually annual) will save you a fairly substantial amount of money compared to paying for multiple short-term policies. If you’re jetting off abroad, double-check that your coverage includes international flying.

Some providers, like Global Aerospace via SkyWatch.AI, include worldwide coverage by default. But they exclude certain restricted countries. So, always confirm the exact territory before flying overseas.

And remember, flying downtown versus out in the country can come with its own set of risks, so choose accordingly.

2. Types of Coverage

We touched upon this topic earlier in this article. You need to be aware of the options available in the market, such as liability insurance, hull insurance, and ground equipment insurance. This knowledge will help you pick the best one for your needs.

If you fly BVLOS (Beyond Visual Line of Sight), conduct inspections on complex infrastructure, or operate in sensitive areas, check with your provider about specific coverage. Most policies don’t include high-risk flights by default.

High-risk operations that often require special coverage include:

- Flights near airports or stadiums

- Tower, bridge, or utility inspections

- Downtown city flights

- Events with large crowds

- Drone delivery trials or BVLOS tests

Note: Most policies will have exclusions. Make sure you are aware of what isn’t covered.

3. Shop Around

When you’re on the hunt for UAV insurance, don’t just jump on the first deal that comes your way. Always play the field by getting multiple quotes. Different providers often have their own spins on rates and what they’ll cover.

While you’re comparing, it’s a smart move to research reviews and see what folks are saying about a provider. This is your inside scoop on how they handle things, especially when it comes to filing a claim. A low rate will feel a lot less fabulous if the insurance company is difficult to work with when you need to make a claim.

Understand what you’re signing up for, check what’s covered, and keep an eye out for any sneaky costs or conditions. Doing your homework now can save you a whole lot of headaches later.

4. Understand What Drone Insurance Doesn’t Cover

- Damaged add-on equipment: Standard hull coverage for drones usually excludes damage to non-drone accessories. For example, Skywatch.AI does not cover computers, mobile phones, non-drone cameras, or tablets. You can protect these items by purchasing extra coverage, such as payload insurance.

- Incidents caused by unlicensed or unregistered drone operators: Commercial drone pilots must hold an FAA license, and all operators must appear on the insurance policy. If you fail to meet these requirements, the insurer may deny your claim.

- Injuries to employees: Workers’ compensation insurance usually covers injuries your employees suffer while working.

- Political or terrorist acts: Insurers do not cover losses that involve political or terrorist activities.

- Reckless or illegal activity: Insurers can deny claims if you fly your drone recklessly, break the law, or intentionally invade someone’s privacy.

- Strikes, riots, civil commotions, or labor disturbances: Insurers typically exclude claims that arise from strikes, riots, or other civil unrest.

- War and rebellion: Insurers do not cover losses caused by war, invasion, rebellion, revolution, insurrection, or martial law.

UAV Insurance: Our Pick

We, at Drone U, switched to SkyWatch.AI several years ago and have been using it since. Skywatch has been a consistent performer and has done a nice job of continually improving. With the size of our fleet, it’s been important that our policy be fairly nimble, as we may have several drones that don’t see the air for months at a time.

With its customizable pricing mechanism, ease of use, and outstanding customer support, we think there’s a pretty good chance SkyWatch.AI drone insurance will be a good solution for many other drone pilots.

Skywatch.ai is backed by the aviation insurance giant, Global Aerospace, a company with more than 100 years of experience in the insurance sector, with an A.M. Best rating of “A” (Excellent).

Conclusion

Whether you’re flying drones as a hobby or for work, getting drone insurance is a smart move.

When choosing UAV insurance, think about what coverage you need based on how you use the drone, your experience, and how much the insurance costs.

Liability coverage is important to cover legal claims and costs if your drone causes accidents. Physical damage coverage protects your drone if it gets damaged in a crash or collision.

If you follow safe flying rules, keep detailed flight records, and get proper safety training, you might be able to get lower insurance costs.

One of the best ways to hone your skills and fly safely is to attend our flight mastery in-person training. This training will help you become a safe and confident drone pilot. Click here to learn more about our Flight Mastery training.

Frequently Asked Questions

1. Is Drone Insurance Mandatory or Required by the FAA in 2025?

The FAA does not currently require drone pilots, commercial or recreational, to carry insurance. However, some states, municipalities, and clients have made it mandatory, especially for commercial pilots. Even when not legally required, drone insurance is strongly recommended to protect pilots from personal financial liability.

If a drone flown by an uninsured pilot causes bodily harm or property damage, all of the financial liability will fall on the pilot. By not getting insurance, a pilot risks losing all his assets.

Remember – If you are buying commercial on-demand insurance, your provider assumes that you have a Part 107 certification. You CANNOT claim damages without a valid Part 107 certificate. Certainly, another strong reason to get your Part 107 license.

2. Are UAVs Covered by Homeowners Insurance?

Probably not if you are a commercial pilot. There are exceptions to this, but most Part 107 pilots will have to purchase a separate insurance policy. If you are a recreational pilot, your drone might be covered under your homeowner’s insurance. However, we strongly recommend that you check the exact nature of coverage with your insurance provider.

3. Does Insurance for Drones Cover Theft?

Some drone insurance policies may include coverage for theft or loss of your drone. Theft coverage is usually optional or part of hull insurance, so pilots should review their policy terms carefully.

4. Can I Get Insurance for My Recreational Drone?

Yes, recreational drone insurance is available to protect your drone from damage. It can provide liability coverage to the drone as well as third-party liability, depending on the policy.

5. Does Drone Insurance Cover Damage to Someone Else’s Property?

Yes. Most drone insurance policies include liability coverage, which protects the pilot if their drone causes property damage or bodily injury to third parties.

6. What Factors Affect Drone Insurance Premiums?

Your insurance premiums depend on several factors, including your coverage type, drone specifications, experience level, and flight history. More experience and a clean flying record usually result in lower premiums.

7. Why Should You Choose Admitted Insurance Carriers?

Admitted insurance carriers hold licenses from the State Department of Insurance where they operate. This status matters because it gives you two major advantages.

Two Reasons to Purchase Insurance from an Admitted Insurance Carrier:

Reason No. 1 – The State Acts as a Regulator

An Admitted Insurance Carrier must comply with all state insurance regulations. That means that Skywatch, for example, obtains the state’s approval before increasing insurance premiums.

Reason No. 2 – The State Protects You if the Carrier Fails

If an Admitted Insurance Carrier goes bankrupt, the state steps in to pay all claims. So coverage from an admitted insurance carrier comes with added protection and ensures peace of mind.

8. When Is It Okay to Use a Non-Admitted Insurance Carrier?

Non-admitted carriers may be appropriate when specialized or higher-risk coverage is needed. These carriers often offer more flexible policy terms, which can be useful for complex or non-standard drone operations.

9. Does My Drone Need to Be Registered with the FAA to Get Coverage?

Each user must agree to the terms and conditions of the carrier they choose to work with. In almost all cases, the T&C’s will require compliance with any Federal, State, Provincial, and/or local regulations. The 2018 FAA Reauthorization Act requires that both U.S. recreational or hobby drones, as well as U.S. commercial drones, be registered and marked.

10. Are Drone Policies Considered Commercial General Liability (CGL) Policies?

No. Drone insurance policies are not the same as Commercial General Liability (CGL) policies. CGL insurance covers broader business risks, such as workplace injuries or property damage unrelated to drone operations.

We do recommend you have a CGL policy in addition to your drone policy. We here at Drone U have our CGL and related policies through NEXT Insurance and have been happy with the relationship.

Add Your Comment